Not known Incorrect Statements About Top 30 Forex Brokers

Not known Facts About Top 30 Forex Brokers

Table of ContentsHow Top 30 Forex Brokers can Save You Time, Stress, and Money.Top 30 Forex Brokers for BeginnersAn Unbiased View of Top 30 Forex BrokersTop 30 Forex Brokers for DummiesThe Only Guide to Top 30 Forex BrokersThe 8-Minute Rule for Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For EveryoneThe Single Strategy To Use For Top 30 Forex Brokers

Each bar graph represents one day of trading and contains the opening rate, highest rate, least expensive cost, and closing rate (OHLC) for a trade. A dash on the left stands for the day's opening cost, and a similar one on the right represents the closing cost.Bar charts for money trading help traders recognize whether it is a buyer's or vendor's market. Japanese rice investors initially utilized candlestick charts in the 18th century. They are aesthetically more attractive and simpler to review than the graph types described over. The upper section of a candle light is utilized for the opening rate and highest possible price point of a currency, while the reduced portion suggests the closing rate and most affordable cost factor.

How Top 30 Forex Brokers can Save You Time, Stress, and Money.

The formations and forms in candlestick charts are made use of to determine market instructions and movement. Several of the extra typical formations for candlestick graphes are hanging male - https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1704973262&direction=prev&page=last#lastPostAnchor and shooting star. Pros Largest in regards to daily trading volume in the world Traded 24-hour a day, five and a fifty percent days a week Beginning funding can quickly increase Generally follows the very same guidelines as regular trading Extra decentralized than typical stock or bond markets Tricks Utilize can make foreign exchange trades extremely unstable Utilize in the series of 50:1 prevails Calls for an understanding of financial principles and signs Less guideline than various other markets No earnings creating instruments Foreign exchange markets are the biggest in terms of day-to-day trading volume internationally and for that reason supply the a lot of liquidity.

Banks, brokers, and dealers in the foreign exchange markets allow a high quantity of leverage, indicating investors can manage large settings with relatively little cash. Leverage in the variety of 50:1 prevails in foreign exchange, though even better amounts of leverage are readily available from particular brokers. Take advantage of must be utilized meticulously because many inexperienced investors have actually experienced substantial losses using even more leverage than was essential or prudent.

Not known Details About Top 30 Forex Brokers

A currency investor needs to have a big-picture understanding of the economic situations of useful source the various countries and their interconnectedness to understand the fundamentals that drive currency values. The decentralized nature of forex markets implies it is less controlled than various other financial markets. The degree and nature of regulation in foreign exchange markets rely on the trading jurisdiction.

Foreign exchange markets are amongst the most liquid markets on the planet. They can be less volatile than other markets, such as genuine estate. The volatility of a particular money is a feature of multiple factors, such as the national politics and business economics of its nation. Events like economic instability in the type of a settlement default or discrepancy in trading partnerships with an additional money can result in significant volatility.

The 10-Minute Rule for Top 30 Forex Brokers

The Financial Conduct Authority (https://www.easel.ly/infographic/c39nss) (FCA) monitors and regulates foreign exchange sell the United Kingdom. Currencies with high liquidity have a ready market and exhibit smooth and predictable price activity in action to exterior events. The U.S. buck is one of the most traded currency in the globe. It is matched up in six of the market's seven most fluid money pairs.

The 8-Second Trick For Top 30 Forex Brokers

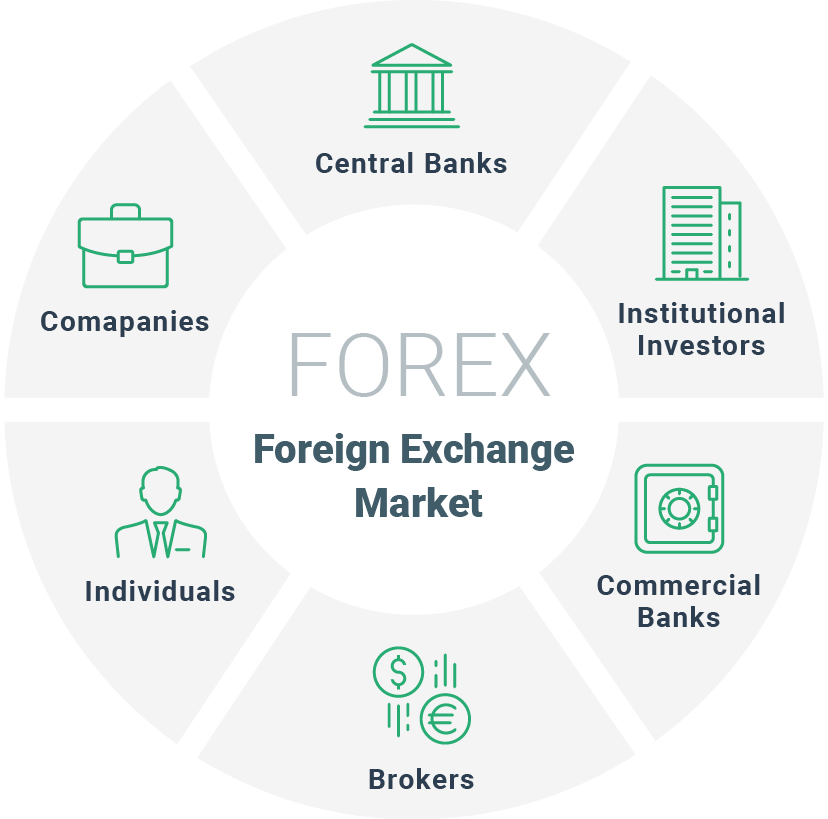

In today's details superhighway the Foreign exchange market is no longer entirely for the institutional investor. The last 10 years have actually seen a boost in non-institutional investors accessing the Forex market and the benefits it uses.

About Top 30 Forex Brokers

Foreign exchange trading (foreign exchange trading) is a worldwide market for purchasing and offering currencies - Exness. 6 trillion, it is 25 times bigger than all the world's stock markets. As an outcome, prices transform frequently for the currencies that Americans are most likely to use.

When you sell your money, you get the settlement in a various currency. Every traveler who has actually gotten international currency has done foreign exchange trading. The trader buys a certain money at the buy rate from the market maker and offers a various money at the selling cost.

This is the purchase expense to the investor, which subsequently is the revenue gained by the market manufacturer. You paid this spread without understanding it when you exchanged your bucks for foreign currency. You would notice it if you made the transaction, canceled your journey, and afterwards tried to trade the currency back to bucks as soon as possible.

The Top 30 Forex Brokers Diaries

You do this when you believe the currency's worth will drop in the future. Companies short a currency to protect themselves from danger. Shorting is extremely high-risk. If the money rises in value, you have to get it from the dealership at that rate. It has the exact same benefits and drawbacks as short-selling stocks.